Tech-Driven Solutions

Artificial intelligence is disrupting many industries across the world, but in the case of the banking sector, the disruptions taking place are pretty deep. The infusion of artificial intelligence tools within banks is not just a trend; it is one very important evolution that has the probable power to have financial services redefined. Be it smoothing operations or bringing a better experience to customers, the impact of AI will be multidimensional and wide-ranging.

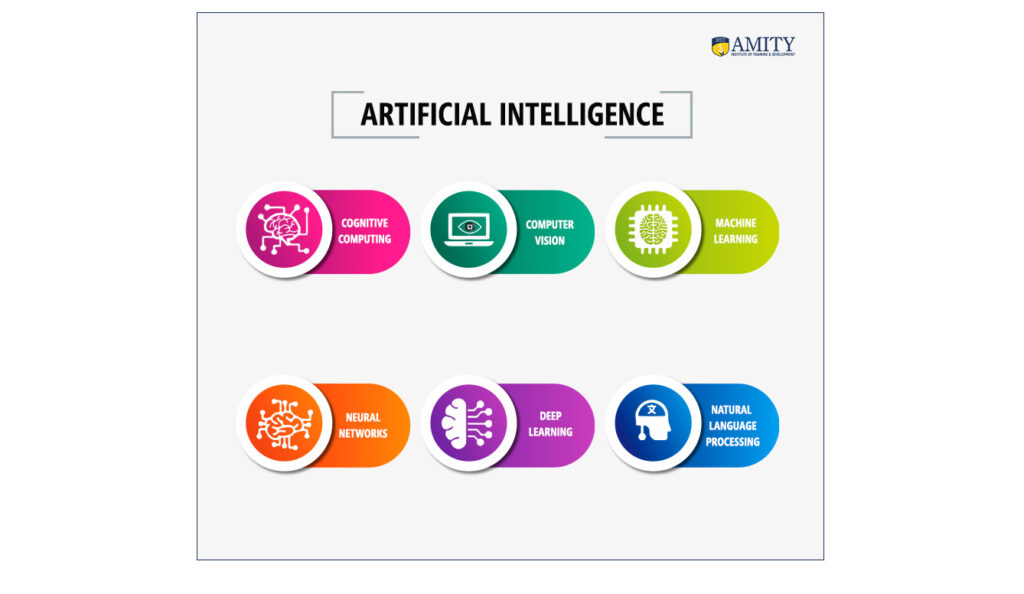

Understanding the Meaning of Artificial Intelligence

Understanding the meaning of artificial intelligence is very crucial to grasping its applications in banking. Artificial intelligence simply refers to simulating human intelligence in machines so that they could do things that would otherwise require human intervention. Such capabilities are exploited through various artificial intelligence tools and platforms available on artificial intelligence websites and developed by artificial intelligence companies.

Artificial Intelligence

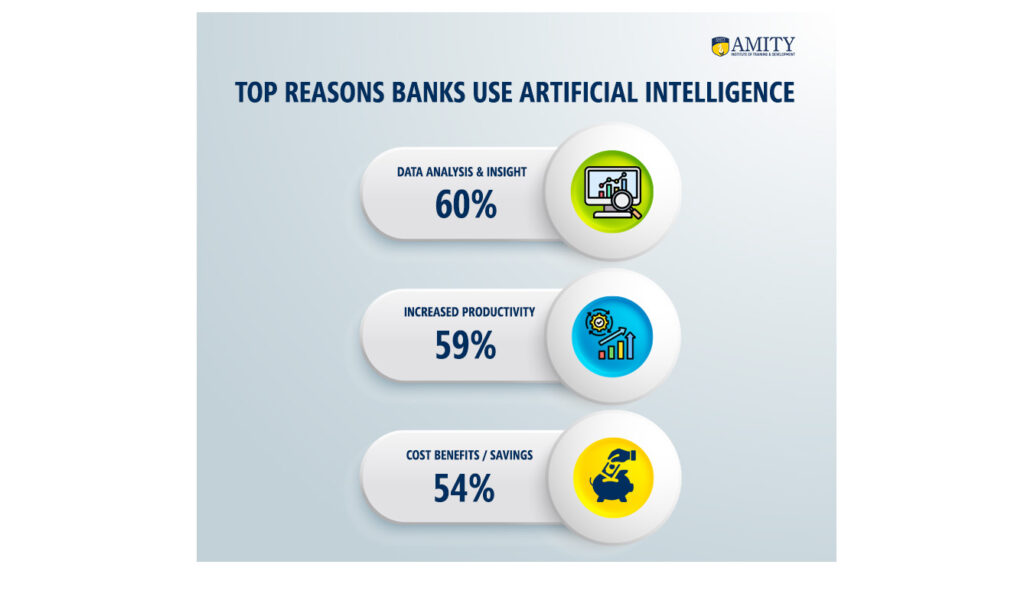

Benefits of Artificial Intelligence in the Banking Sector

Artificial intelligence comes with many benefits in the banking sector. It helps solve a number of problems common in the banking sector by detecting and managing risk and fraud to improve customer service delivery. It facilitates reform within the sector of banking through automating compliance processes and making sure there are strategic insights. Therefore, this necessarily creates demands for artificial intelligence jobs in banking, forcing many professionals to seek artificial intelligence training in a bid to remain competitive, as well as courses on artificial intelligence.

The Future of Artificial Intelligence in Banking

A promising future of artificial intelligence in banking is seen with continuous improvisations where innovative solutions are obtained to enhance efficiency. Artificial intelligence in the field of the latest banking sector news shows how crucial it can be in making a difference in the future for this industry. Education in the field of technology, like artificial intelligence in education, ensures that the professionals of the future are not lacking in this, hence a knowledgeable workforce.

Types of Artificial Intelligence Utilized in Banking

Various types of artificial intelligence are utilized in banking to fulfill different needs. For example, chatbots developed with AI enhance customer service, while predictive analytics have given much-needed impetus to decision-making procedures. The continuous artificial intelligence research in the domain is leading to the development of more advanced applications.

Did you know?

AI can look at your expenditure pattern and advise on personalized financial products? That is, your bank may suggest to you the best credit card or loan that suits your consumption habits.

Increasing Demand for AI Professionals in Banking

With technological advancement in the banking sectors, the need for able professionals is also increasing, subsequently increasing banking sector vacancies. Most of these vacancy positions require professionally trained experts in AI, thus raising the demand for artificial intelligence online courses and related training programs.

AI is probably the most important thing humanity has ever worked on.”

–Google CEO Sundar Pichai

The Relevance of AI in the Indian Banking Industry

This statement from Google CEO has become quite relevant in the Indian banking industry, especially after demonetisation. With an average Indian consumer getting at ease with online banking, making internal operations efficient and the customer experience more effective has certainly become a new normal in modern banking. COVID 19 had triggered online banking the push it was looking for and had accelerated the use of emerging technologies like AI at full throttle. Improving data quality and expanding reach are some of the other critical factors giving more impetus to AI in banking of today. About 32% of financial service providers are already using AI technologies like predictive analytics, voice recognition among others, according to joint research conducted by the National Business Research Institute and Narrative Science.

(Source: Paymentscardsandmobile)

The Critical Role of Artificial Intelligence in Future Banking

It is clearly evident that Artificial Intelligence has become one of the critical pillars laying the foundation of future banking in India. Artificial Intelligence is not only leading analytical solution, but also redefining the way customers interact with modern day services provided by the banks. It’s becoming a remedy for challenges faced by banks like customer experience personalization and loyalty building at one hand to security features such as anomaly detection or fraud prevention on the other.

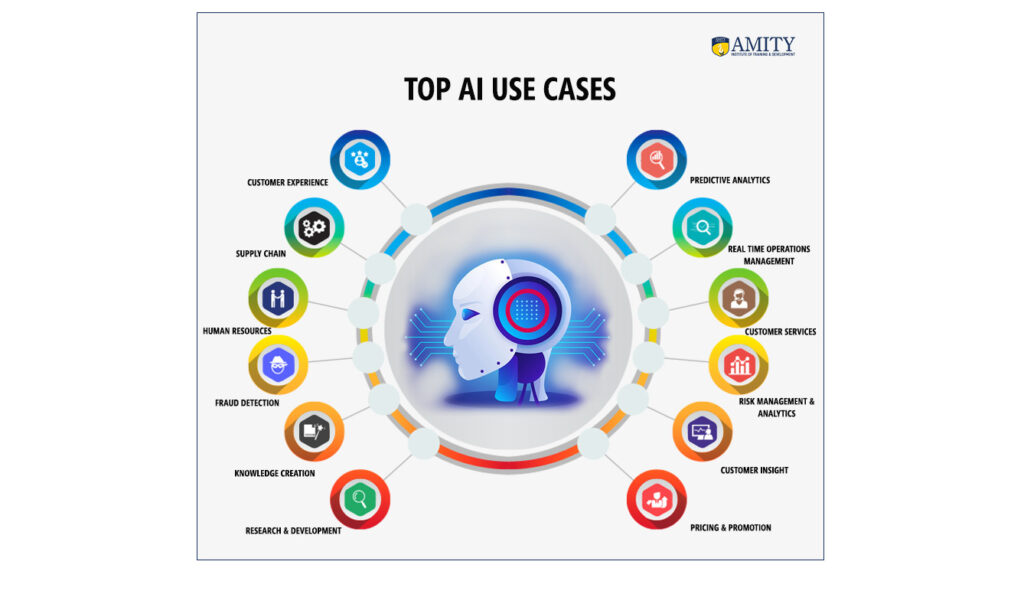

Key Areas Impacted by Artificial Intelligence in Banking

Presently Artificial Intelligence is impacting every area of bank operations, customer relationship management, fraud detection as well as risk management. In order to simplify it further these aspects can be divided into four thrust areas:

– Sales optimization

– Driving business growth

– Streamlining operational processes

– Credit risk management

(Source: Benefits resulting from the use of AI in FinTech, Synerise)

Besides these four major areas impacted by Artificial Intelligence, there are some other features such as AI bots, digital payment advisers and biometric fraud detection mechanisms that lead to higher quality of services to a wider customer base.

The Future of Artificial Intelligence in the Indian Banking Sector

According to Deloitte, AI will provide the foundation for increased product and service innovation. Further, artificial intelligence has the potential to transform customer experiences and establish entirely new business models in banking. To achieve the highest level of results, there needs to be a collaboration between humans and machines that will require training and a reassessment of the future of work in banking. Also, mass customisation is the key to unlocking significant opportunities in the future and can be tapped only through technologies like AI and blockchain.

Upskilling Bank Employees for AI Integration

It is imperative that the bank employees are upskilled to understand AI at a broader level and are adept in leveraging the benefits of Artificial Intelligence which will help them to serve their customers better. To help banks bridge this knowledge gap, Amity Institute of Training & Development (AITD) in partnership with industry leaders have been developing cutting edge research-based programs which are easy to deploy in both virtual and physical environments.

Did you know?

AI detects and predicts the market trend as well as the needs of customers to customers with outstanding accuracy. Depending on the finding, banks develop new products and services to meet the emerging demands.

Interested in Learning more about the topics, here are a few links to relevant researches and studies conducted:

Utilization of artificial intelligence in the banking sector: a systematic literature review

ARTIFICIAL INTELLIGENCE IN INDIAN BANKING SECTOR: CHALLENGES AND OPPORTUNITIES

Artificial Intelligence (AI) in Banking Industry & Consumer’s Perspective

Conclusion

AI has, therefore, not only integrated computers and artificial intelligence in the banking sector, but has given this integration new meaning. This extended definition gives banks innovative solutions to traditional problems and opens up ways for a more effective, secure, and customer-oriented financial environment.

Did you know?

AI systems detect fraudulent transactions within milliseconds. These systems monitor all transactions; upon detection of any unusual activity, it is flagged to aid in enabling the prevention of fraud from taking place.