Tech-Driven Solutions

The BFSI (Full form – Banking, Financial Services, and Insurance) industry plays a very crucial role in transforming the economic landscape of nations around the world. With this sector heading into 2025 and beyond, changes will come with the support of technology, regulatory changes, and shifting consumer expectations. This has enormous implications for professionals, investors, and consumers alike in understanding and effectively engaging with this dynamic environment.

Did you know? The BFSI sector covers all aspects, from conventional banking to blockchain and artificial intelligence, as well as new-age technologies and financial technology companies, thereby revolutionizing financial services from its very core.

As we discuss the top trends shaping the BFSI sector in 2025 and beyond, it is first important to note the multifaceted factors that contribute to these changes.

Some of the key trends which will change the landscape of the sector are listed below:

1. Digital Transformation and Fintech Integration

The BFSI industry is rapidly integrating fintech solutions in order to better service delivery and operational efficiencies. Trends such as these highlight the continued digital transformation that has caused traditional banks to make arrangements with fintech companies so as to provide more innovative financial solutions to clients. The cases start with mobile banking applications and then through blockchain technology to offer smooth and safe services to customers.

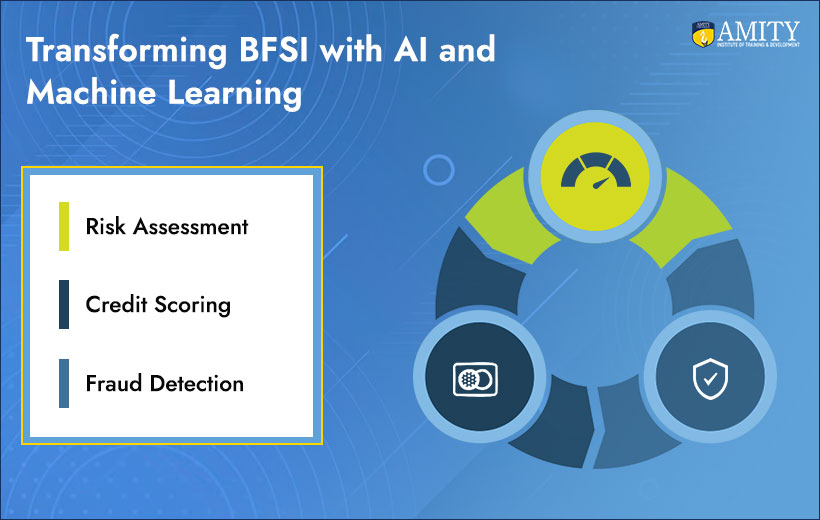

2. AI and Machine Learning Adoption

AI and machine learning are transforming the BFSI industry, allowing an institution to get insights into humongous data within a very short span of time. Such technologies allow credit scoring, fraud detection, and risk assessment, thereby making the operations more efficient and reliable. This phenomenon will transform the way institutions will operate and decide in 2025.

3. Blockchain Technology

Blockchain technology will proliferate in the BFSI sector through the empowerment of transaction transparency and security. By 2025, cross-border payments, smart contracts, and identity verification security will widely witness blockchain usage. This technology promotes operational efficiency while minimizing fraud and operational risks.

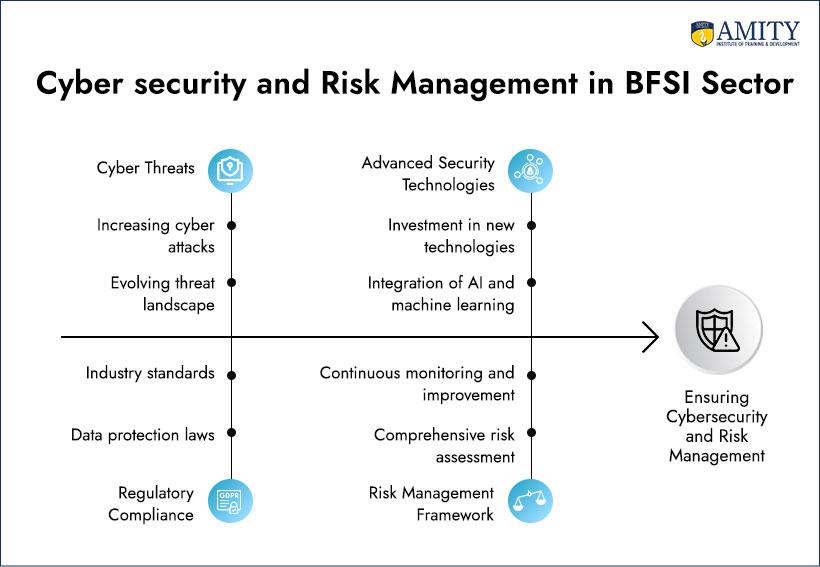

4. Cybersecurity and Risk Management

As digital channels keep on multiplying, so do the cyber threats that create risks. In the BFSI sector, safety measures regarding cybersecurity will be at the topmost by 2025 because this sector is very sensitive to the proper use of customer information and always keeps it protected. Key investments in advanced security technologies and risk management frameworks will be required to safeguard assets and ensure regulatory compliance.

5. Data Analytics for Personalization

Data analytics is at the heart of personalization in the BFSI sector. The institute uses big data to understand exactly what their customers do, what they want, and how much or little they require in finance. This trend would further use tailored marketing strategies with a focus on customised financial products, thus improving the experience of the customer and creating loyalty.

6. Customer Experience Focus

Coming with a rise in digital banking, now customer experience is on the front. Banking institutions start to use data analytics and client’s feedback to tailor their services and, as a result, improve the customer satisfaction level. Some of the key strategies now include AI-driven support options through chatbots and customised advice on financial matters related to the specific spending of the customers.

7. Financial Inclusion

Increasing demand for financial services would most definitely ensure that people gain access to banking at an enhanced level, thereby ensuring a higher level of financial inclusion is maintained.

Keeping financial inclusion at its core, there is an immense requirement for the welfare of the governments and organisations across the world. The BFSI sector is making best use of the power of technology to reach out to those unbanked populations, connecting them to fundamental services that allow them to access finance.

Mobile banking and microfinance are regarded some of the most critical initiatives aimed at enhancing financial literacy and economic empowerment across developing regions.

8. Neo-Banks

Neo-banks are the trend of digital-only banks without physical branches. They serve the most tech-savvy customers with mobile banking solutions. They charge lower fees and innovative features that appeal to the younger demographic. As market share continues to grow, traditional banks will be challenged to alter their competitive viewpoint.

9. Regulatory Changes and Compliance

The BFSI sector is strictly governed by strong regulatory frameworks, and 2025 will be characterized by the adoption of more stringent measures of compliance. For institutions, this will mean the adaptation to new regulations aimed at enhancing transparency and customer protection. These regulations are a key learning need for professionals working in the sector for compliance and risk minimization purposes.

10. Sustainable Finance

Growing emphasis on sustainable finance stems from stakeholder awareness of ESG. Increasingly, more financial institutions will make investment and product choices with considerations of a greater number of ESG factors. It is reflective of the overall trend towards sustainability and ethical investing in society that significantly goes beyond affecting consumer behavior to affect corporate strategy.

11. Remote Work and Hybrid Models

The pandemic has catalysed a shift towards work from home in the BFSI industry. Hybrid work models most likely dominate 2025 and then attract talent from anywhere in the world into institutions. Internal workplace policies and investments in technology need to be reassessed here to build on and retain productivity through remote collaboration.

12. Better Training and Development Programs

Organisations will continue to invest in training and development programs for their workforce to keep up with the ever-changing BFSI landscape. Enclosing the skills of employees in emerging technologies, regulatory changes, and customer service strategies will remain at the forefront of competitiveness and innovation drivers.

Role of Technology in Re-Shaping the BFSI Sector

Technology is the backbone of BFSI evolution. It has automated routine jobs, as well as fortified security measures, to transform the delivery of financial services. Ahead of us in 2025 will be various technologies-the AI, machine learning, and blockchain-continuing to drive efficiency and innovation, thus better equipping the financial institutions putting these to work with regard to meeting customer expectations in the rapidly changing environment.

Do You Know? Most traditional banks invest heavily into technology startups these days to stay ahead of the fintech curve which is constantly changing. This shows just how innovative the BFSI sector has become.

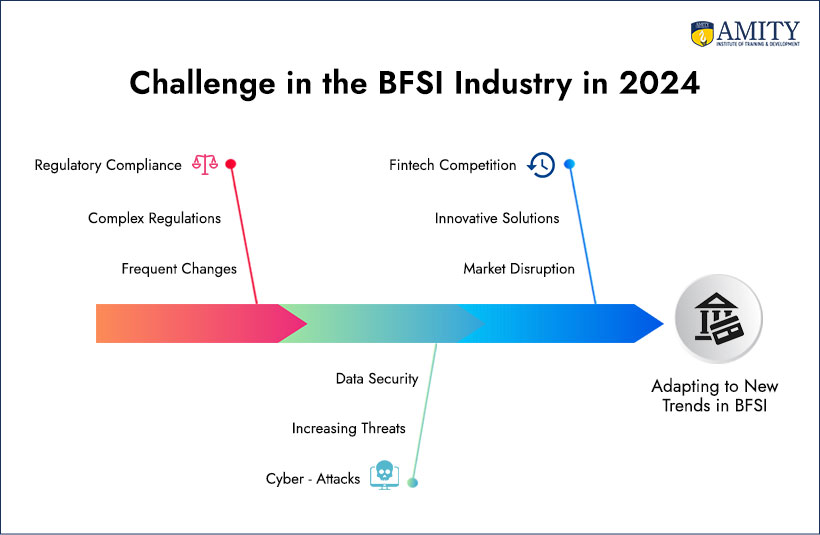

What Are the Three Challenges That the BFSI Industry Will Experience in 2025?

New trends in the BFSI sector will mean their adoption but also challenges that would come with them, including regulatory compliance, threats from cyber-attacks, as well as increasing competition from fintech firms. To adapt to these challenges requires an agile and proactive approach in the risk management structures.

How will Consumer Expectations Change?

Consumer expectations are always changing with relentless pressure of technological advancement as well as increased access to information. For the year 2025, customers will look for more personal and seamless experiences from financial institutions; hence, it will continue to nourish innovation in the organisations.

What Skills Will Become the Most Critical for BFSI Professionals?

To keep up with this industry evolution, professionals will require new skill sets to stay ahead. Data analytics, technology management, and customer relationship management must be implemented in the journey for successful success within the BFSI segment.

How AITD Can Help?

Amity Institute of Training and Development (AITD) looks at equipping professionals within the BFSI industry (Provides bespoke BFSI Courses) with the skills and knowledge in a rapidly changing environment. AITD will be providing tailor-made training programs targeting financial management, risk assessment, and regulatory compliance. These are designed to prepare for the challenges and opportunities lying ahead in the BFSI sector.

Our programs are focused on the following:

- Building Digital Payment Interfaces

- Data Security and Data Breach in Banking Industry

- Credit Risk Management Program

- Program on Foreign Trade

- NPA Management Program

- Induction Program for New Hires

- Behavioral Training

- Finacle

- First time Managers/Branch Managers

- Core Banking System

- Business Ethics and Corporate Governance

Interested in Learning more about the topics, here are a few links to relevant researches and studies conducted:

BANKING AND FINANCIAL SERVICES INDUSTRY(BFSI) TRENDS IN 2023 AND BEYOND: EXCERPTS FROM LITERATURE

From potential to performance by design, Banking, Financial Services & Insurance Report

BFSI Industry – A Future Skills Perspective

Final Thoughts on Trends in the BFSI

BFSI is in a revolution spree, changing towards emerging trends in technology, consumer behavior, and regulatory frameworks. Understanding such trends is crucial for professionals who want to navigate such a dynamic landscape well. And to thrive, success within the changeable BFSI sector into 2025 and beyond will rely on being well-informed and proactive.

Did You Know? The incorporation of AI in the BFSI Industry could help in better working operation by automation of routine work and professionals may invest their time on a higher strategic approach.