Tech-Driven Solutions

Digital transformation will change the insurance sector big time. It will bring in fresh ideas and a better set of customer services. Insurers are using AI, machine learning, and big data to work smarter and faster.

According to an online survey, 67% of insurance executives believe that AI will change the industry a lot in three years. More than 80% said they will spend more on AI. Going digital allows a firm to provide self-service capabilities and customized products. Today’s savvy technology users demand it, and market leaders in India, where the insurance business is expanding, will need to keep pace.

The blog discusses the digital developments taking place in the insurance sector in India.

Key Takeaways

- Digitalization is the path to the new age modernization of the insurance industry.

- Technology brings in efficiency coupled with customer delight.

- This is important training for a new time: AITD.

- Insurers must respond to changing customer needs quickly.

The Need for Digital Transformation in the Insurance Sector

In the digital age, the old insurance no longer cuts it. Customers want very fast and easy interactions with their insurers. Things become smoother and more personal when you use digital tools.

DO YOU KNOW? Almost 80% of respondents prefer to work with technology-friendly insurers.

Digital Transformation Services: Base Necessity for Insurance Companies

Several aspects compel insurance to change digitally:

- Changing Consumer Expectations: Today people want quick service. They look forward to streamlining digitalization for policy management and claims.

- Technological innovations: Insurance today is transforming into AI, ML, and blockchain. This means such tools would contribute to value-added risk assessment, fraud detection, and customer service.

- Regulatory Requirements: The insurance sector regulatory body of India also allows digital movement; this further boosts transparency and efficiency.

- Cost Efficiency: Automation reduces cost and error. This means huge savings for insurers.

DO YOU KNOW? Spending on insurance technology is projected to rise more than 25% during the period between 2022 and 2026.

Discover Digital Transformation Technologies in the Insurance Industry

To compete, insurance firms embrace digital transformation:

Processes Automated

Automation plays a huge role in the insurance business. It enables processing tasks such as underwriting and claims processing quickly and inexpensively.

Mobile Apps

Mobile apps are becoming more common in the insurance world. They give customers easy access to insurance services and information on their phones. It makes things faster and easier.

Data Analytics

The digital shift of the insurance world leans heavily upon data analytics, meaning that tools applied help such insurance companies understand the preference of customers, risks, and decision-making.

DO YOU KNOW? By 2025, 80% of insurers will use digital strategies to get ahead.

The Future of Indian Insurance Sector: Embracing Digital Transformation

Since the adoption of digital services, the insurance sector in India is accelerating at a lightning-fast pace. It is because more people now opt for digital services and want immediate efficient help. The COVID-19 pandemic also made the necessity of digital work and digital talk even more important. The Indian insurers are now using AI and big data to facilitate customers better and work efficiently.

Benefits of Insurance Companies Health through Digital Transformation Strategies

With growth in the digital world, many benefits can be seen flowing to the insurance companies:

- Better Customer Experience: Advanced data enables insurers to offer custom products and services.

- Efficiency of Operations: Digitization decreases errors, processes become smooth, and tasks are automated.

- Better Risk Management: Big data will help insurers understand risks better.

- Agility in Innovation: With digital change, insurers can respond rather quickly to market change.

Zhang et al. (2024) in their paper titled “Index construction and application of digital transformation in the insurance industry” give a comprehensive report on very large transformations in the industry. In the report, it discusses how digital disruption affects the value chain of the industry. This shows that China’s index of digital optimization increased annually by about 20.46 percent between the years 2014 and 2020. This therefore indicates that it is growing fast but steadily as well. The study goes to put some inputs into the future of digital sustainability.

How Are Insurers Adapting to Digital Transformation Trends?

Insurance companies embrace new trends such as omnichannel communications and mobile applications. Indeed, these changes positively influence their interactions with customers and the internal working structure. Companies may invest in appropriate digital services to make their operations more effective and responsive to customer demands.

DID YOU KNOW? The global InsurTech market is estimated to reach USD 10 billion in 2025 based on digital services.

Overcoming Obstacles in Digital Innovation for Insurance Companies

Despite the advantages, there are disadvantages for insurers as well:

- Legal systems: Some use old systems, which are even harder to handle with the new technologies with.

- Resistance Culture: Employees may resist new work culture approaches. Leaders must encourage innovation.

- Skills gaps: Technologies evolve very rapidly. Employees need to be continually trained to be updated.

To overcome these challenges, firms require training. Programs like those offered by Amity Institute of Training & Development (AITD) can be the solution. With such skills acquisition, it would not be difficult for insurers to easily benefit from digital growth while bypassing obstacles.

How AITD’s Digital Transformation Courses Enhance Skills in the Insurance Industry

AITD plays an important role in developing professionals. They have a digital Technology course. The course equips with skills to manage changes in the insurance world.

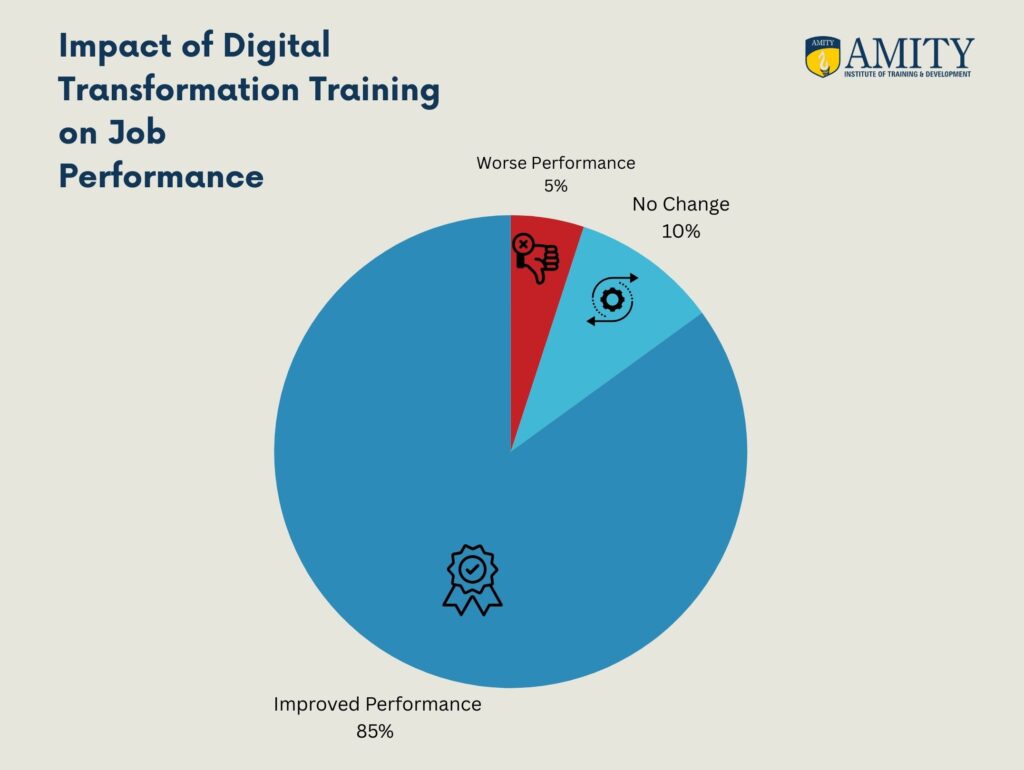

DO YOU KNOW? 85% of AITD graduates have seen improvements in job performance following the completion of their digital adoption programs.

Transform Your Career with AITD’s Digital Transformation Framework

- Learning by industry experts; AITD brings learning to participants from industry experts.The training by these experts provides education to participants on transformational technologies and trends related to the insurance industry.

- Tailor-Made Learning: The learning programs have been tailored towards meeting the needs of the Indian insurance sector. This implies that participants acquire knowledge relevant to their jobs.

- Practical Applications: AITD applies innovative methods in real-world environments. This enables trainees to implement knowledge gained into their respective organizations.

Leveraging Digital Transformation Service Benefits by AITD Training

- Optimized Business Operations: It lowers costs and delivers higher-quality services when learning how to automate and leverage data analytics.

- Enhanced Customer Satisfaction: Training through AITD facilitates the use of digital tools for proper engagement with customers and, therefore is bound to satisfy them.

- Strategic Insights: The knowledge from AITD helps companies develop strong digital strategies. This keeps them competitive in a changing market.

DO YOU KNOW? AITD has seen a 40% increase in enrollment for digital disruption courses over the past year.

Is Your Insurance Company Ready for Digital Innovation? AITD Offers Solutions

The shift in technology significantly affects the insurance industry. One pertinent question is: Is your insurance company geared for these changes? New competition and needs in customers are affecting them; therefore, attention to their digital strategies is imperative.

Organizations such as AITD are playing a significant part in this process. They offer to train individuals to become good leaders at the helm of their companies leading through change. Through digital transformation courses from AITD, insurance companies can enhance their service delivery and cover better customer needs.