Tech-Driven Solutions

The BFSI sector is one of the sectors that have always been at the forefront in terms of technological disruption. AI is no exception. It has brought revolution within the industry as it changes the BFSI way of doing things as well as optimizes their internal processes while improving the customer experience. In this very long article, we will dig deeper to understand how AI impacts the BFSI sector and what the benefits are.

Did You Know? AI has been in use even from the 1980s in the BFSI industry. Most of its adoption was for the sake of fraud detection and credit scoring; now, however, it really picks up a lot of applications.

Impact of AI in the BFSI Industry

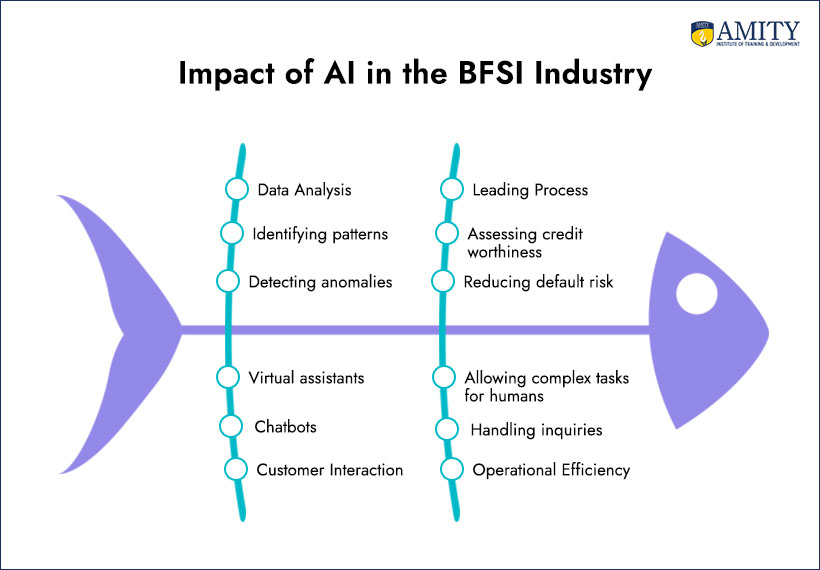

AI has penetrated all the possible facets of the BFSI domain, that is, from customer service to risk management. An important effect of AI has been in the analysis of humongous data sets and extracting important insights. The algorithms of AI enable banks and financial institutions to make decisions on patterns and anomalies emerging from the data-driven insights.

AI is also changing the interface between banks and their customers. Chatbots and virtual assistants, again driven by AI, have now pervaded the BFSI space. They allow for 24/7 customer support along with recommendations. AI can take care of the most varied inquiries a customer makes-from account balances to loan applications-with human employees being able to focus on more complex work.

But, above all these, AI is transforming the entire lending process in the BFSI sector. Based on an individual’s credit history, income, and spending habits, AI algorithms can measure creditworthiness far better than the conventional methods. This reduces default risk significantly but also empowers banks to provide loan products more customized to the customer’s needs.

Why AI is Critical to Fraud Detection and Cybersecurity

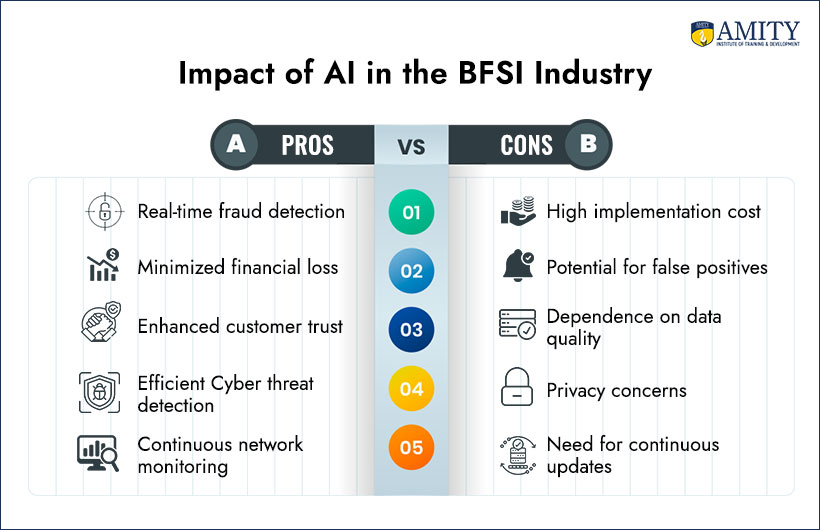

Data security and fraud prevention are key, important elements of the BFSI industry. In this regard, AI emerges as an important tool because it has the capability to detect and prevent fraud in a real-time manner by analyzing transactions, identifying suspicious transactions, and raising an alert to the concerned authorities, minimizing financial loss and loss of customer trust.

Beyond fraud detection, AI has been a game-changer for the BFSI segment in strengthening security. The AI-powered algorithms quickly and efficiently detect cyber threats that could not be traced by traditional forms of security. AI-powered cybersecurity systems continuously monitor network traffic and become sensitive to weaknesses, allowing banks and financial institutions to stay one step ahead of cyber thieves.

How AI is Revolutionizing Risk Management in the BFSI Industry

One of the very important applications in the BFSI sector is the space of risk management. AI is enriching the precision and speed of the process through in-depth analysis of enormous historic data and market trends that enable prospective risks to be identified and thus mitigation strategies to be devised. This besides reducing financial loss also minimizes blunders and resources for better exploitation.

AI is also transforming the way portfolios are operated in banks and other financial services institutions. AI algorithms can find trends in markets and behavior of customers and eventually look out for potential investment opportunities while optimizing the performance of a given portfolio. This may position the banks and financial services institution in a better position compared to its competitors as it assures greater value-added services to the customers.

What is the Future of BFSI with AI?

However, with such further advancement and sophistication in AI, the impact would be even more tremendous for the BFSI industry. For example, in the near future, we may have to experience a large spectrum of applications that range from usage of AI-powers technologies-for example, customized financial planning and automated trading.

The first sector where AI will surely make its mark is in the domain of wealth management. The personal financial goals, risk tolerance, and investment preferences of an individual can be worked upon by AI algorithms to develop suitable strategies and make recommendations.

This will optimize investment returns for wealth managers as well as allow for providing value-added services to clients.

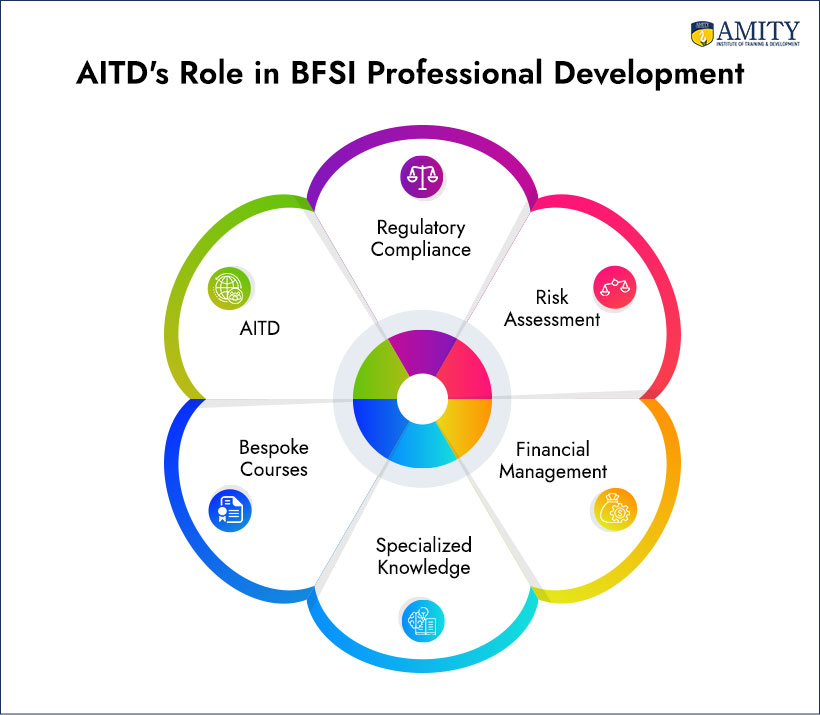

How AITD Can Help?

Amity Institute of Training and Development (AITD) offers specialized bespoke courses to equip the professionals with knowledge and skills required to thrive in BFSI Industry. We tailor programs for financial management, risk assessments, and regulatory compliance for them, thereby making us a very important partner for anyone willing to advance in such a career path.

Our programs are focused on the following:

- Building Digital Payment Interfaces

- Data Security and Data Breach in Banking Industry

- Credit Risk Management Program

- Program on Foreign Trade

- NPA Management Program

- Induction Program for New Hires

- Behavioral Training

- Finacle

- First time Managers/Branch Managers

- Core Banking System

- Business Ethics and Corporate Governance

Interested in Learning more about the topics, here are a few links to relevant researches and studies conducted:

BANKING AND FINANCIAL SERVICES INDUSTRY(BFSI) TRENDS IN 2023 AND BEYOND: EXCERPTS FROM LITERATURE

From potential to performance by design, Banking, Financial Services & Insurance Report

BFSI Industry – A Future Skills Perspective

Final Thoughts on The Impact of AI on BFSI

The impact that AI will have on the BFSI industry is nothing short of revolutionary. From bettering customer experience to changing the internal process, AI will be transformative in how banks and financial institutions are run. With this trend having the potential to continue, AI will make an even bigger mark on the BFSI industry going forward.