Tech-Driven Solutions

The BFSI sector is regarded as one of the most tightly regulated sectors around the world, encompassing banking, financial services, and insurance. Regulation performs an important function in safeguarding the integrity of financial institutions as well as ensuring that the interests of customers in the BFSI industry are being safeguarded.

So, what all is included in the BFSI sector one may wonder…

The BFSI sector includes banking institutions, financial services such as asset management and wealth management, payment processing, and insurance companies. This sector will greatly be playing its part in every economy by churning out the required financial services and products that the individual and the businesses require to sustain in the economy.

Consequently, as integration in the global finance sector increases and with awareness regarding the peril of cyber security growing, regulation over the BFSI is further progressed. With the year going towards its end and changing over into 2024, it is essential that professionals working with BFSI update themselves about the changes in regulatory trends so that organizations do not fall behind but remain compliant and competing all the way.

Did you know? Financial regulations contribute to stability in a market, protection of customers from fraud, and even advance the risk management of financial institutions.

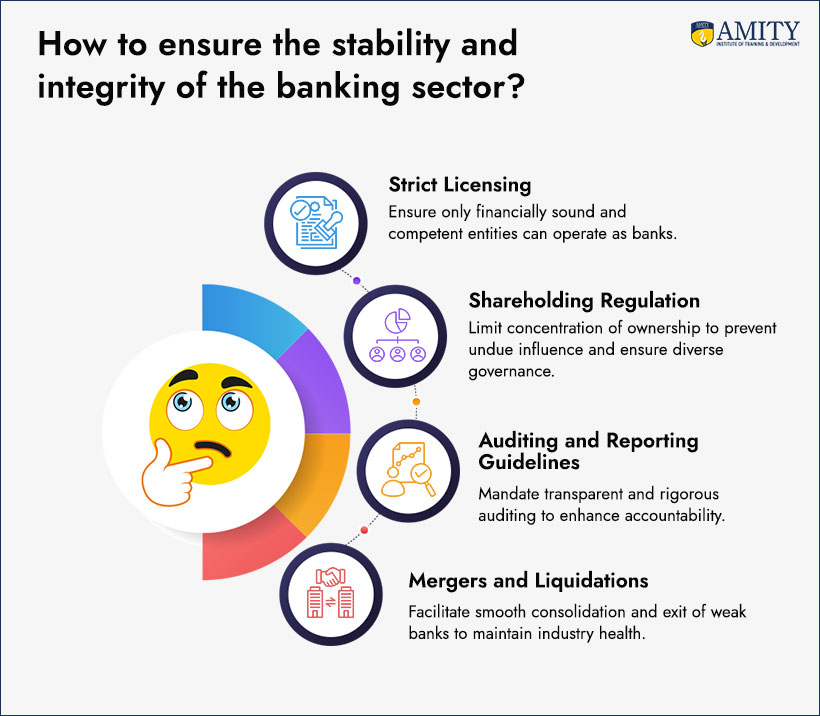

The Banking Regulation Act: The Critical Support Pillar

The Banking Regulation Act, enacted in the year 1949, is the foremost legislation of banking in India. This act grants to the RBI regulatory powers to oversee and supervise banking institutions. This act enunciates the rules and regulations for banking activities, licensing, and operations in a manner that ensures transparency, solvency, and the security of public deposits.

Significant aspects of the Banking Regulation Act

- Issue of banking licenses.

- Regulation of shareholding and voting rights in banks.

- Providing guidance on auditing and reporting of banking institutions.

- Effecting the mergers and liquidations of banking institutions.

The Act has undergone a series of amendments to align with the changing needs of the bank industry, especially towards recent updates on issues concerning non-performing assets (NPAs) and corporate governance of banks.

Top 10 Regulatory Trends in the BFSI Sector

Strengthening Cybersecurity Regulation

With diversified digital services offered by financial institutions, cybersecurity has always been at the forefront. Regulation bodies are increasingly insisting on strong rules and guidelines to ensure that the data of customers is safe and online banking transactions secure. BFSI organizations need to review the risks and cybersecurity frameworks from time to time to create defence mechanisms against emerging cyber threats.

Data Privacy Compliance

The rampant collection of private data has seen regulations like the GDPR in Europe and India’s Data Protection Bill give direction on how financial institutions collect, retain, and administer customer data. BFSI companies are now bound to collect, process, and store data on individuals considering privacy regulation developed to be very stringent in nature. Non-compliance would attract heavy penalties and a considerable reputational cost.

Open Banking Regulations

Open banking has changed the face of the banking industry by allowing third-party service providers to access consumer banking data through APIs. Regulatory frameworks have been developed to ensure that open banking practices remain secure, thus protecting consumers’ financial information. This would also pave the way for fair competition as fintech firms develop innovative solutions for customers.

Environmental, Social, and Governance (ESG) Compliance

The increase in sustainability consciousness around the world has increased regulations forcing financial institutions to adopt business operations that take into consideration environmental, social, and governance factors. Regulatory authorities are demanding sustainable practices from organizations and asking them to report on sustainability initiatives, lower carbon footprints, and responsibly invest in green finance.

Consumer Protection Laws

Consumer protection has also come out as a focus of financial regulation. In recent trends, there is regulation of enforcing transparency in loan agreements, fees, and charges. Regulation bodies also focus on mis-selling of financial products and proper financial education given to customers by institutions.

Banking Regulatory Reporting

Financial institutions have the responsibility of making detailed reports on their health at financial, risk management, and operational performance to respective authorities. It is through such reports that allow the authority to get an overview of the monetary stability of the institution and act based on such information. It is expected that come 2024, pressure on accurate timely reporting will intensify.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

AML/CTF Regulations The regulators are still very interested in the AML and CTF policies that help smoothen the way for the prevention of illegal activities in the financial system. BFSI organizations have to implement basic, stringent, and robust KYC protocols, reporting of suspicious activities, and strict monitoring practices.

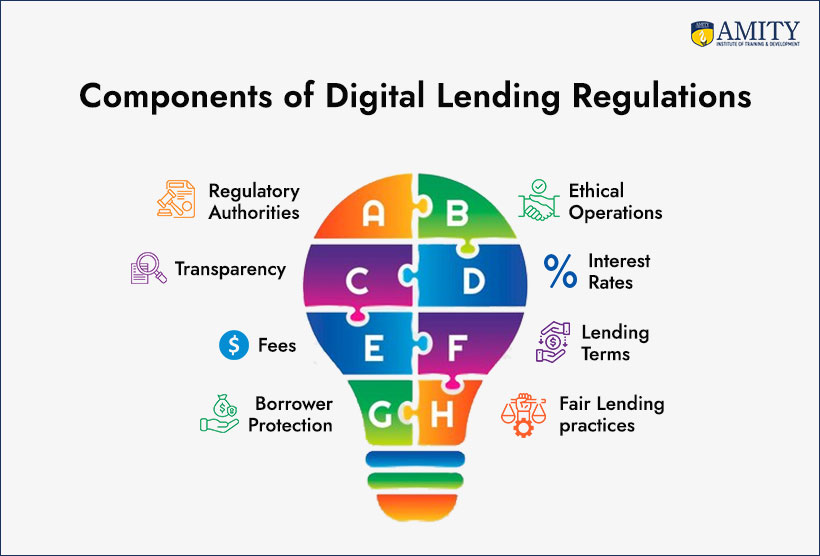

Digital Lending Regulations

The digital lending platforms should be operated within the confines of regulatory authorities to ensure that they continue operating ethically and in an openly transparent manner. New regulations are being introduced to reign in interest rates and fees and lending terms being charged to increase protection of borrowers along with fair lending practices.

Risk Management and Capital Adequacy Regulations

Capital adequacy and risk management regulations have become more stringent post the 2008 financial crisis. Strengthening guidelines of the Basel Committee, the regulatory bodies have made the capital requirements for the banks rise higher with implementation across the globe and in India. Thus, preparing the banks from shocks.

Cross-Border Compliance

As the BFSI industry has become more borderless, compliance takes the form of international financial reporting standards (IFRS) and regulations for cross-border data sharing. Therefore, institutions in the BFSI sector have to comply not only with norms at home but also around the world.

Role of Regulatory Bodies in India

India has a complex banking and financial environment under the control of multiple regulatory bodies. Some of the most significant banking regulatory bodies in India include:

| Logo | Regulatory Authority | Description |

| Reserve Bank of India (RBI) | Central regulatory authority for banks and financial institutions. | |

| Securities and Exchange Board of India (SEBI) | Regulates securities markets and protects consumer interests. | |

| Insurance Regulatory and Development Authority of India (IRDAI) | Oversees the insurance sector in India. | |

| Pension Fund Regulatory and Development Authority (PFRDA) | Manages pension funds and policies in India. |

These governing bodies ensure that the financial institutions operate within the purview of the law and protect the interest of the customers and also help to ensure financial stability.

Do you know? RBI originates from the year 1935, while its principal work involves control of banknote issue and holds reserves and to operate the credit and currency system of the country.

What does Compliance in BFSI mean?

Adherence of financial institutions towards various regulatory requirements by the governing bodies is termed BFSI compliance. This encompasses anti-money laundering regulations, data privacy laws, capital adequacy norms, as well as cybersecurity guidelines. Dedicated compliance teams need to be in place within BFSI organizations to ensure that all regulatory standards are being met.

Which are the major regulatory requirements by BFSI Organizations?

BFSI organizations are under strict compliance regulations. Some of the requirements include capital adequacy, regulatory requirements for banking, liquidity management, and operational risk. A few of the things they have to comply with are consumer protection and data privacy guidelines, along with a thorough understanding of corporate governance limits that would prove these organizations operate ethically and transparently.

How AITD Can Help?

Amity Institute of Training and Development (AITD) has developed a number of specialized training programs designed to update BFSI professionals with the latest trends in regulatory necessities. With knowledge on Banking Regulation Act, mastering BFSI compliance, and far more, AITD readies professionals to meet the highly dynamic changes taking place in the regulatory landscape. Tailor-made courses are available for this modern day BFSI workforce from topics like financial management, risk assessment, regulatory reporting, etc.

Our programs are focused on the following:

- Building Digital Payment Interfaces

- Data Security and Data Breach in Banking Industry

- Credit Risk Management Program

- Program on Foreign Trade

- NPA Management Program

- Induction Program for New Hires

- Behavioral Training

- Finacle

- First time Managers/Branch Managers

- Core Banking System

- Business Ethics and Corporate Governance

Interested in Learning more about the topics, here are a few links to relevant researches and studies conducted:

BANKING AND FINANCIAL SERVICES INDUSTRY(BFSI) TRENDS IN 2023 AND BEYOND: EXCERPTS FROM LITERATURE

From potential to performance by design, Banking, Financial Services & Insurance Report

BFSI Industry – A Future Skills Perspective

Final Thoughts on Regulatory Trends in the BFSI Industry

BFSI, today, is witnessing tremendous changes from the advancement of technology to customer demand and regulations. By 2024 and onwards, therefore, for BFSI professionals, it’s only mandatory to be one step ahead of the regulatory curve so that, in terms of compliance, the organizations they work for are way ahead in the game. Understanding key shifts like cybersecurity measures, ESG compliance and new consumer laws can thus navigate some of the complications of the financial landscape.

Did you know? The new banking regulations keep coming in to avoid financial crises and safe-guard the economy. Therefore, it is crucial that the professionals of the BFSI sector also update themselves on the same.