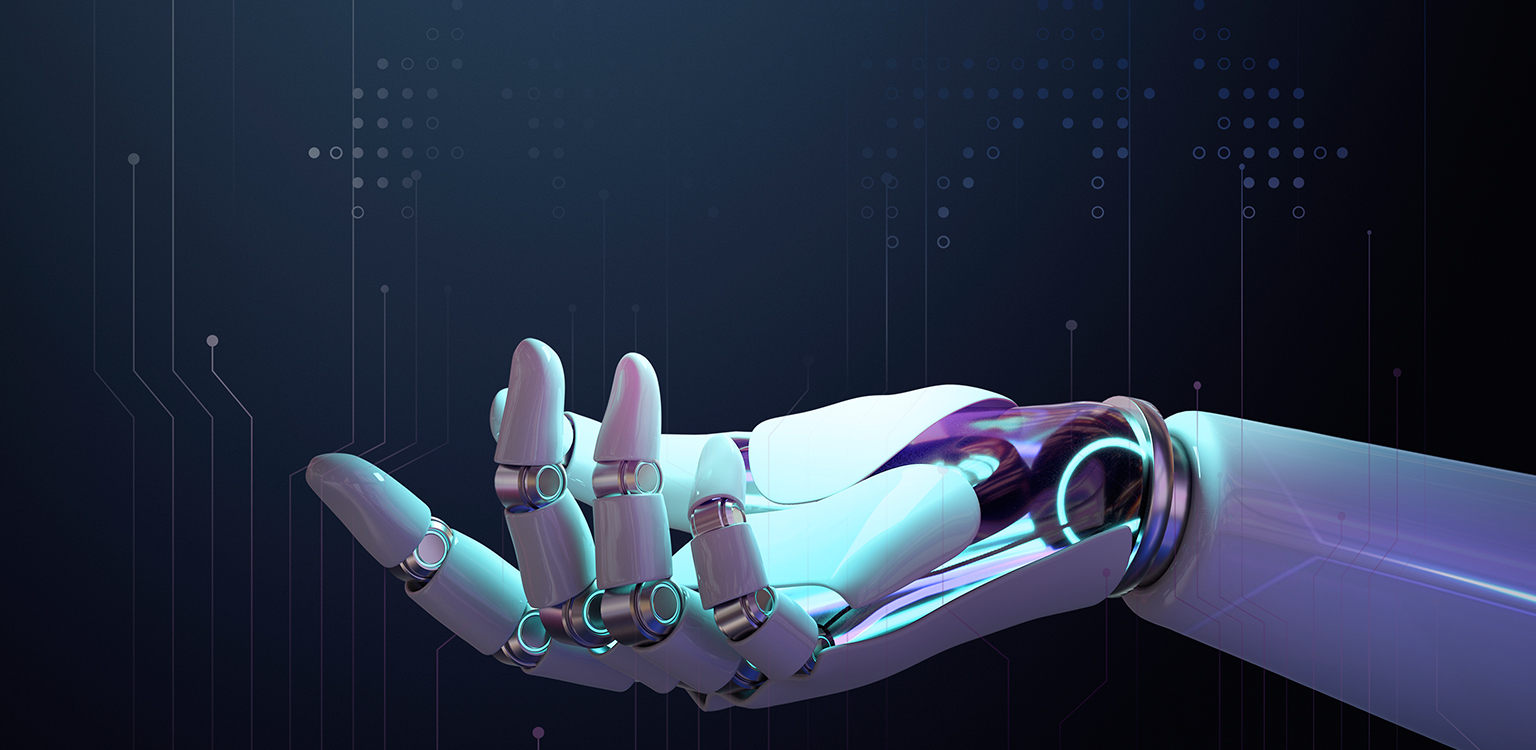

Our BFSI training programs are designed exclusively for organisations, equipping your workforce with the skills needed to lead in an ever-evolving financial landscape. Tailored to meet industry-specific challenges, our training enhances decision-making, risk management and leadership capabilities, ensuring your organisation stays ahead of the competition.

AITD provides premier training in sales, customer relationship management, on-boarding, soft skills, managerial effectiveness, leadership and emerging technologies such as data science and digital transformation. Additionally, we offer specialized programs in credit, lending, risk management, cyber-security and compliance.

Recent events have highlighted that disaster recovery plans alone are insufficient; businesses need robust strategies to ensure seamless operations, accessible tools and sustained employee productivity from any location. In response, our BFSI customers are increasingly investing in banking and BFSI training courses to meet these evolving demands.